Renters Insurance in and around Medford

Medford renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

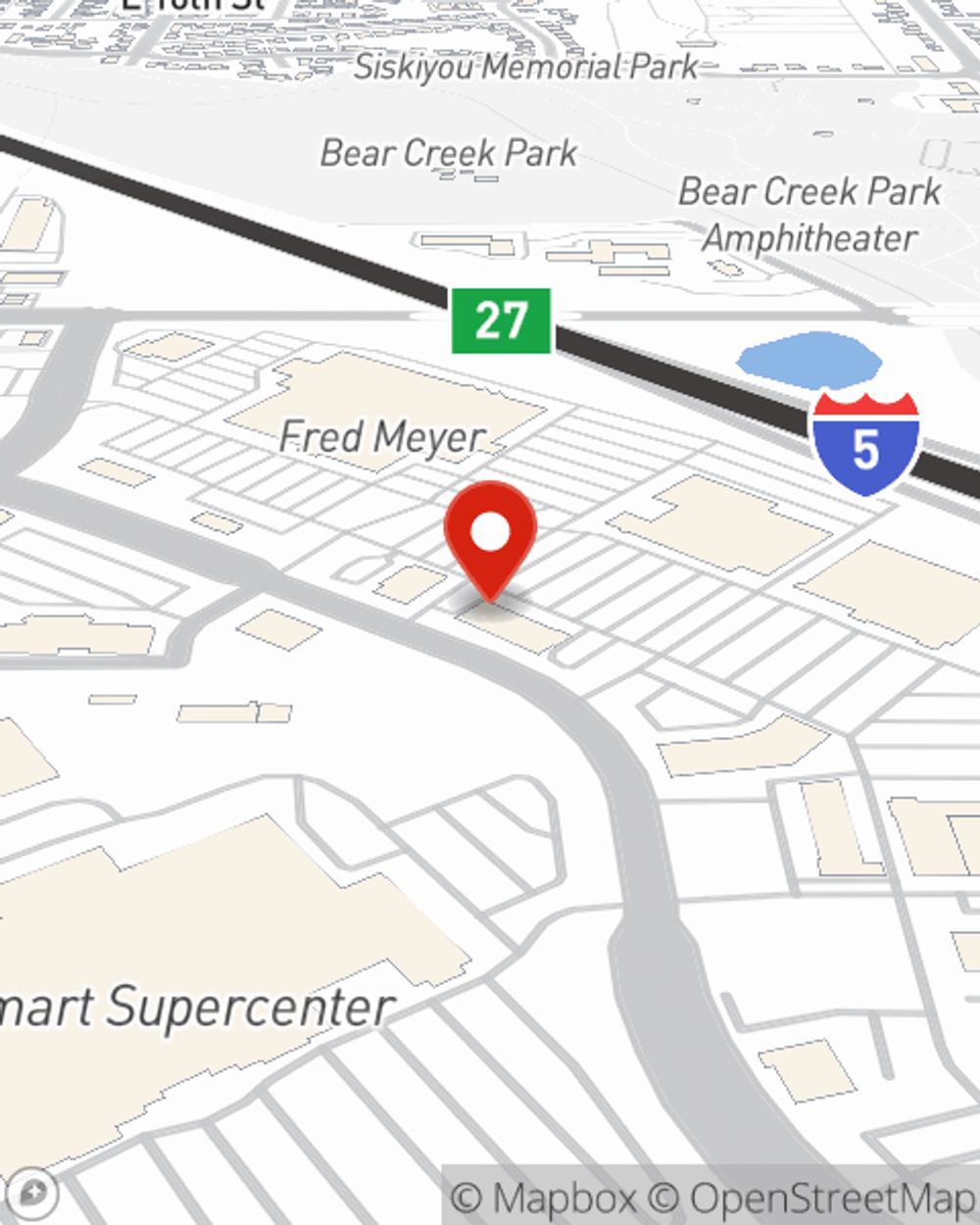

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your smartphone to your microwave. Not sure how much insurance you need? Not to worry! Brad Linnell stands ready to help you identify coverage needs and help secure your belongings today.

Medford renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

Renting is the smart choice for lots of people in Medford. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance could cover the cost of water damage to walls and floors or tornado damage to the roof, that won't help you replace your possessions. Finding the right coverage helps your Medford rental be a sweet place to be. State Farm has coverage options to correspond with your specific needs. Luckily you won’t have to figure that out alone. With personal attention and reliable customer service, Agent Brad Linnell can walk you through every step to help you build a policy that safeguards the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Medford renters, are you ready to learn how you can protect your belongings with renters insurance? Reach out to State Farm Agent Brad Linnell today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Brad at (541) 535-5505 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Brad Linnell

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.